Why Your Health Insurance Plan Won’t Cover Functional Nutrition

One thing is common for us all - we are wildly in the dark about how health insurance works and who decides what’s covered. That is why my intention with this article is to offer clarity and education, so you can stop blindly allowing your health insurance plan choose your providers for you, and make more informed health decisions for yourself.

Why Your Health Insurance Plan Won’t Cover Functional Nutrition

It’s no secret that the healthcare system in the U.S. is a bumbling sh*tshow. We’ve privatized health insurance plans since the 1920s, causing costs to soar, excluding important health services, and making plans effectively useless to those who are relatively healthy.

It’s a complex issue, and a highly controversial one. I’ve worked in healthcare for 20+ years, both on the clinical side, and the billing side. I can’t change our severely broken system on my own. But, one reader at a time, I can help individuals like you know how to advocate for your own health when seeking out health insurance plans and healthcare services.

Hi darlings. I’m Hilary Beckwith, ex-dieter and holistic nutrition expert. Clients come to see me with signs of adrenal stress and inflammatory conditions, and my job is to find the root causes so we can address their symptoms more effectively and fill in the gaps between what their doctor is saying and what their body is saying. Click here to read my Medical Disclaimer.

In this article, you’ll learn:

is health insurance necessary?

what it means to use an “in-network” provider

the difference between “covered” and “non-covered” services (it might not be what you think)

is health insurance necessary?

For about nine years in the early 2000s, I worked for a large chain grocery store. I wore many hats there, but one of my jobs was to help change price tags when a new ad started every Wednesday.

I and my crew would replace expired sales tags with their regular price, as well as replace regular-priced tags with the new sales tags.

Every sales tag also showed the product’s regular price, so you as the customer could see how much you were saving by getting it on sale.

Here’s where things get shady…

Very often, when a product would go on sale, the store would increase the regular price of that item so that it looked like you were saving more money. When the sale ended, the regular price went back to its normal market rate.

In other words, the regular price on a sale item was completely arbitrary - it was used as a marketing tool to show how much the customer would “save”. [insert barfing noise]

Here’s the thing… Your health insurance plan does the same thing.

I’ll talk more about that later in the post. But first, let’s explore whether a health insurance plan is even necessary to have.

holding space

I want to be clear - the realities that we all live in are so different. What I have to say in this article will not relate to everyone. We each have different values and different needs to consider when choosing healthcare services and utilizing health insurance plan benefits.

One thing is common for us all - we are wildly in the dark about how health insurance works and who decides what’s covered. That is why my intention with this article is to offer clarity and education, so you can stop blindly allowing your health insurance plan choose your providers for you, and make more informed health decisions for yourself.

It is not at all meant to suggest that no one benefits from using health insurance. Plenty of individuals rely on private, state, and federally funded insurance plans to provide treatment for chronic illness and other medical conditions, and I hope to present this article with some sensitivity to that.

Earlier this summer I had a pretty serious injury - I fell while rollerskating, fracturing my ankle in three places, dislocating the joint, and detaching a ligament.

It required a trip to the E.R., surgery to repair the damage, multiple sets of imaging (before and after surgery), physical therapy, etc..

As a functional nutrition practitioner, I often look to treatment options that are root-cause-focused, as opposed to symptoms-focused. An injury like this requires a different approach.

I leaned into Western medicine (mostly covered by my health insurance plan), but I also utilized my nutrition background to optimize my healing, support bone density, regulate inflammation, regulate my nervous system after a traumatic injury, and support detoxification from pain meds (all not covered by my insurance).

So, was it necessary to have a health insurance plan in this instance?

I would argue yes… sort of…

I’ve already put in thousands of dollars toward premiums over the four years I’ve had this health insurance plan. Was it worth it for peace of mind? That’s debatable. Many Americans are terrified that the cost of healthcare, even with insurance, will lead them to crippling debt. You can read about my research on this topic here.

I certainly think there is a place for insurance, and an accident like this one is a good example of when insurance is necessary. But privatized insurance has been driving healthcare costs up (and up, and up…) since the 1920s [1], making quality healthcare largely inaccessible to many in the low or middle classes nearly 100 years later.

We’re all stuck between a rock and a hard place.

using an in-network provider

I think most of us understand that when using health insurance plan benefits, the question we most commonly ask a practitioner is, “do you take my insurance?”. After all, being in-network means the care will be cheaper, and in some cases is the difference between coverage or no coverage.

After working for nearly 25 years in medical clinics, I’ve learned that most people do not understand how their insurance works. And who can blame you!

SOME THINGS YOU MAY NOT KNOW ABOUT HEALTH INSURANCE:

INSURANCE IS A CONTRACT

The patient has a contract with their health insurance plan, as do any in-network practitioners. As with any contract, the terms look different for every health plan, but in general, the terms of patient-insurance contracts boil down to this:

IF the patient pays their portion, THEN insurance will pay theirs. Despite common belief, it is not the other way around.

PRACTITIONERS ARE NOT REQUIRED TO SUBMIT CLAIMS

It is not the responsibility of a practitioner to submit claims or pre-authorization requests on behalf of a patient. Practitioners typically take it on themselves simply because it’s easier for them to directly supply the information required by the insurance company, rather than have the patient be a liaison.

IT IS THE PATIENT’S RESPONSIBILITY TO UNDERSTAND THEIR OWN BENEFITS

Some practitioners are kind enough to give patients a cost estimate for care based on their insurance benefits - but it is not the practitioner’s responsibility to do so.

IT IS THE PATIENT’S RESPONSIBILITY TO APPEAL

Very often, health insurance plans deny services that should be covered according to the plan benefits (I recently experienced this, myself). In many of those cases, the practitioner is kind enough to submit an appeal on the patient’s behalf, again, because it is easier for the practitioner to directly submit required documentation. But it is not the practitioner’s responsibility to do so.

A PRACTITIONER WHO IS IN-NETWORK, TAKES A PAY CUT

If a practitioner is in-network with your health insurance plan, it means they have a provider-insurance contract with the insurance provider. That contract, in essence, says that in exchange for advertising (i.e. a directory, or network, of “preferred” practitioners), practitioners agree to discount their care, so that the insurance does not have to pay out as much.

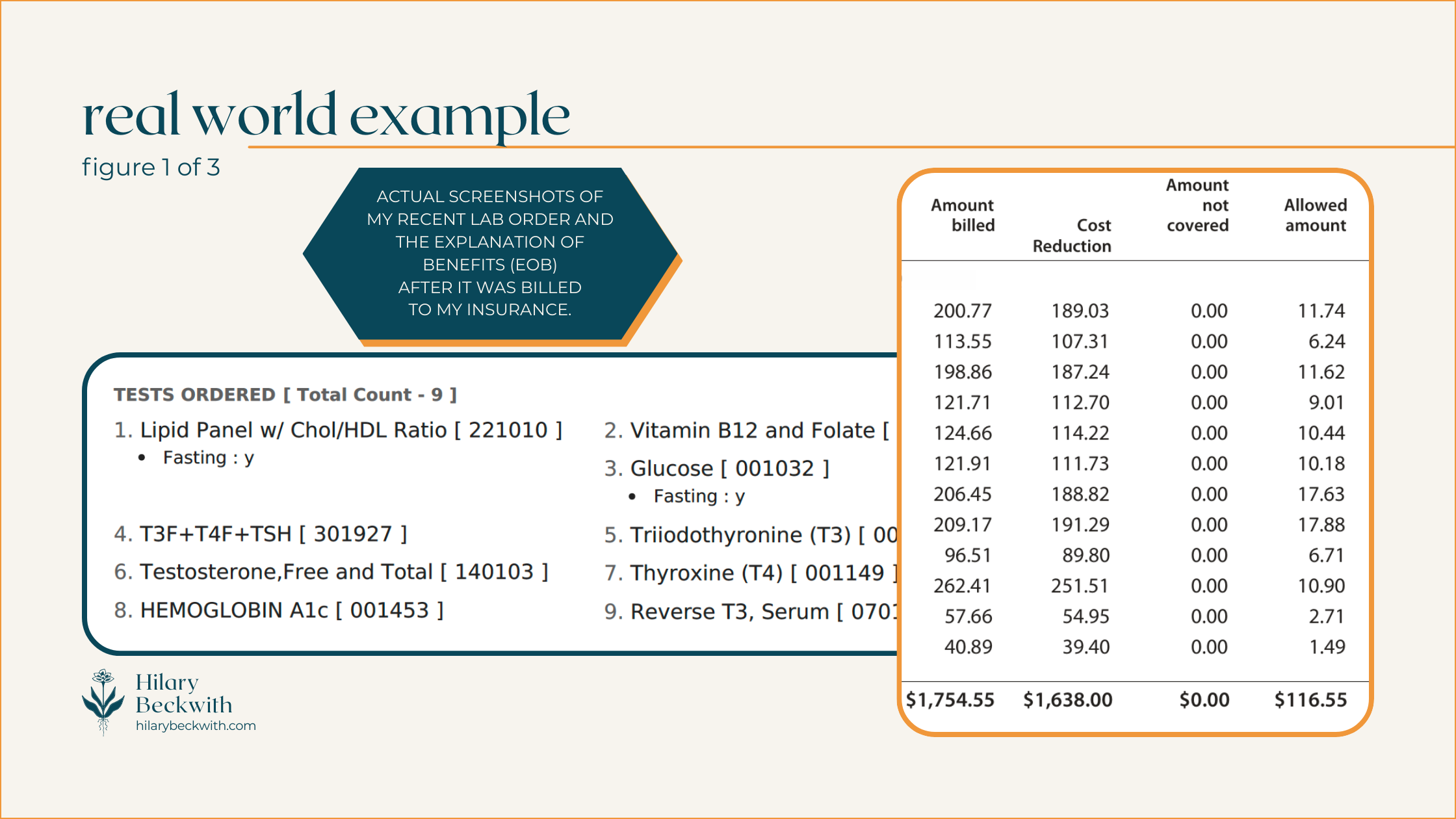

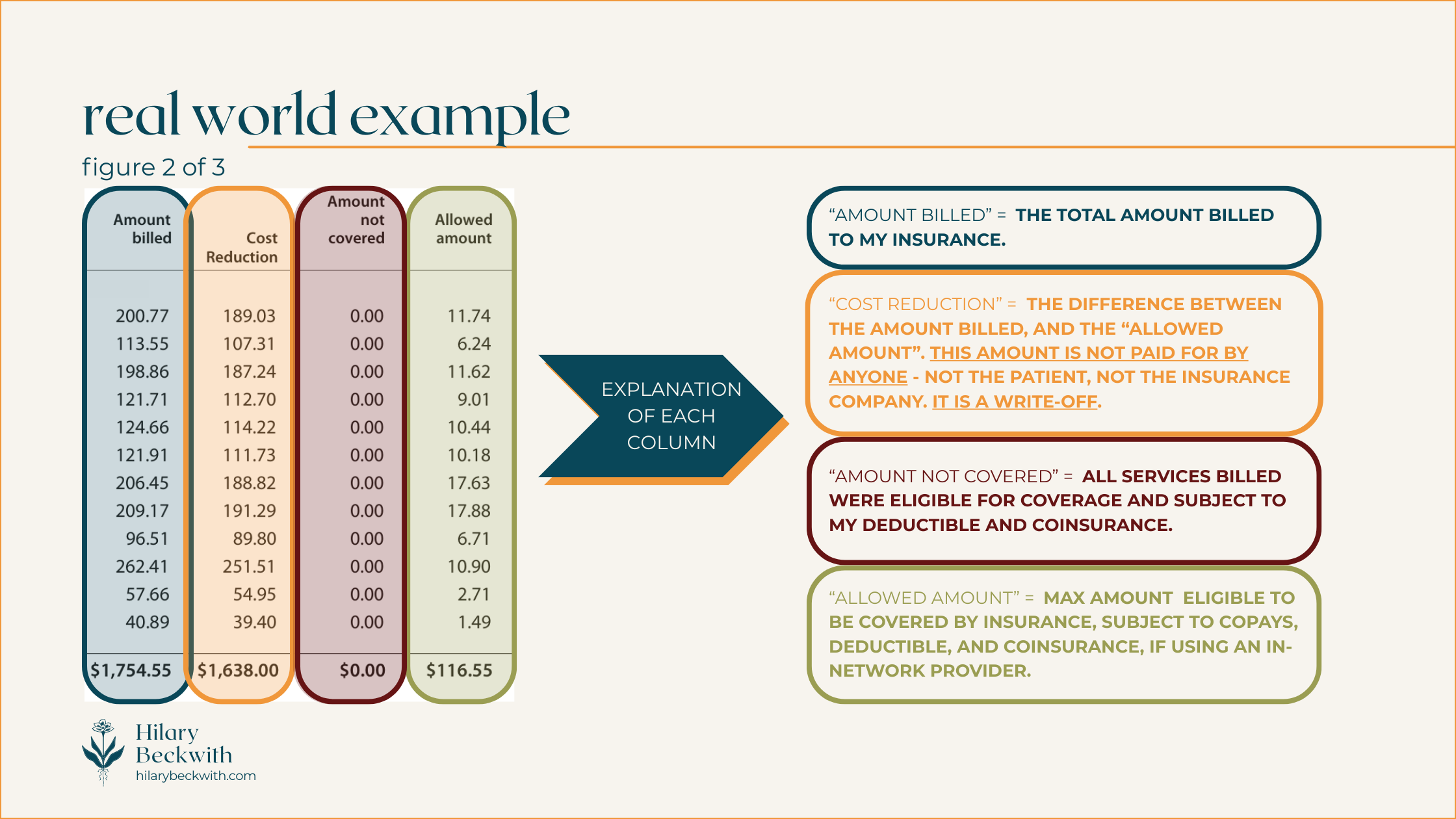

Patients will often see these discounts conveyed as “you saved $___!” on their Explanation of Benefits (EOB).

IN-NETWORK PRACTITIONERS MAY BE LESS LIKELY TO SEEK OUT ROOT CAUSES OF YOUR SYMPTOMS

When practitioners are contracted with an insurance plan, they are subject to the regulations of that plan.

A common example of this is regarding thyroid testing. Many health insurance plans in the U.S. stipulate that in order to diagnose hypothyroid, TSH must be high, and free T4 must be low. Therefore, even if the patient has many other indications of hypothyroidism, your in-network practitioner will likely only test for TSH and fT4, unless you request otherwise.

Put more simply, health insurance plans are not designed to keep relatively healthy people, healthy. Health insurance plans are designed for symptoms-focused care and injuries.

Most health insurance plans do not cover services designed to optimize your health, such as functional lab testing, somatic work, treatments for complex trauma, and, yes, holistic nutrition consulting.

They’ll happily cover sleep medications, blood pressure medications, or weight loss surgery - but they will not cover the types of care needed to address root causes of insomnia, high blood pressure, and weight gain.

covered v. non-covered services

Health insurance is confusing - that’s why I’m here to bring some clarity to your world when navigating healthcare decisions, and those confusing EOBs.

I’ve included some diagrams below to help you understand things a bit better. But first, let’s talk vocabulary.

WHAT DO THESE COMMON HEALTH INSURANCE TERMS MEAN?

COVERED SERVICES:

A “covered” service is any service that is eligible for coverage, meaning it meets criteria set by the health insurance plan, including diagnosis, practitioner type, and plan inclusions.

A service that’s “covered” does not necessarily mean it is paid for by your insurance. A “covered” service is still subject to your plan benefits, such as deductible, coinsurance, or co-pay.

NON-COVERED SERVICES:

A “non-covered” service is any service that does not meet criteria set by the health insurance plan. The cost of a non-covered service is entirely the responsibility of the patient.

A service might be considered “non-covered” for the following reasons:

it is specifically excluded from your health insurance plan benefits

it was provided by an excluded practitioner type (e.g. a blood draw may not be covered if it is performed by a Naturopath if Naturopaths are excluded from your plan)

your diagnosis does not meet the requirements set by your insurance plan for the service to be covered - this does not mean your practitioner incorrectly diagnosed you.

the service was performed in a non-covered clinic or facility (e.g. getting Physical Therapy in a hospital setting may be covered differently than it would in an office setting).

IN NETWORK

Indicates a practitioner, facility, or group of practitioners, are contracted with a health insurance plan. As we discussed earlier, services from an in-network practitioner usually indicates “covered” service costs will be discounted.

OUT OF NETWORK

Indicates a practitioner, facility, or group of practitioners, are not contracted with a health insurance plan. Out-of-Network does not necessarily mean services will not be covered - but it does mean the costs will not be discounted.

DEDUCTIBLE

A dollar amount set by your health insurance plan, if applicable, that the patient must pay before the insurance begins paying for services. Coverage after the deductible is met varies from plan to plan.

EXAMPLE: If your insurance has a $1000 deductible, you must pay for services in full until they reach a total of $1000, after which your insurance will start paying according to your plan benefits. This only applies to “covered” services. Any non-covered services will not apply toward your deductible.

COINSURANCE

Not to be confused with a co-pay, a coinsurance is a percentage set by a health insurance plan that the patient is responsible to pay for all covered services. Most often, a plan that includes a coinsurance also includes a deductible, and similarly only applies to “covered” services.

EXAMPLE: If your insurance requires you to pay a 20% coinsurance, your insurance would pay 80% of covered services, and you would pay 20%. Typically this is applied after a deductible has been met.

CO-PAY

A co-pay is a flat-rate amount set by a health insurance plan that patient is responsible to pay for every eligible practitioner visit. Co-pay plans are very rare these days, and typically do not entail a deductible or coinsurance.

EXAMPLE: If your health insurance has a $30 co-pay, you would pay $30 when visiting a covered practitioner providing covered services, and insurance would pay for the rest. Some insurance plans may require separate co-pays for different types of services, even if they are provided by the same practitioner in the same day (e.g. a physical exam and a spinal manipulation may require two separate co-pays for the same visit)

do I take insurance?

Nope!

Or rather, it’s that insurance doesn’t take me.

As you’ve learned in this post, health insurance plans in the U.S. are more likely to cover treatments designed to suppress symptoms or change lab values.

It might even help you feel better for a time. But it won’t be the solution to your PCOS symptoms, IBS symptoms, weight gain, or anxiety. Those symptoms will all still be there the moment you stop taking the medications.

That’s why my work is focused on helping clients find and address root causes of their symptoms, not just changing lab values.

want to see what you’re missing?

learn something new?

Please share your thoughts and questions below.

NUTRITION SERVICES

ADDITIONAL RESOURCES

BLOG REFERENCES

Friedman, Jordan. “How Health Insurance Got Its Start in America.” History.Com, A&E Television Networks, 27 May 2025, www.history.com/articles/health-insurance-baylor-plan.